Trusted by the most popular Banks in South-East Asia

Why Choose NightVision FX For Your Bank?

The digitalization trend and rapid developments in the FX market necessitate that banks adopt NightVision FX – an automatic FX transaction management platform. NightVision FX plays a pivotal role in elevating a bank’s overall performance, supporting banks to provide superior services to clients and strengthening its position in the highly dynamic FX market landscape.

- Standardize & Simplify

By standardizing and simplifying the automated FX trading process, NightVision FX aids banks in monitoring and reducing the risk of errors, while providing a frictionless experience and more reliable trading environment for customers. - Enhance Operational Efficiency

In foreign currency operations, automation lessens the need for manual processing and human involvement, which leads to faster execution, lower operating expenses, and increased productivity. - Fuel Breakthrough Growth

Automation enables faster execution of trades and quicker market opportunity response. Banks can capitalize on market movements more promptly, attract clients looking for timely execution, thereby achieving breakthroughs in FX market. - Build Positive Reputation

Utilize NightVision FX’s technological prowess to propel your banks to the forefront of innovation and establish them as a significant and renowned partner for both domestic and international businesses engaged in FX trading. - Enhance Customer Satisfaction

Banks can offer consumers faster and more effective FX services by leveraging the power of our platform’s broad capabilities, which will increase customer happiness and retention.

Our Solutions

NightVision FX Helps Bank Has Greater Efficiency & Better Service

Night Vision FX stands as an empowering solution meticulously crafted to furnish banks and branches with the indispensable tools required to thrive, enhance services, and lead in today's foreign exchange trading market.

Effortless Transaction

Management

Easily create, edit, or cancel transactions across various channels: online, fully automated counters, or semi-automated continuous counters.

Quick Transaction

Execution

Transactions are carried out swiftly, minimizing exchange rate volatility risks for both customers and branches.

360-degree

Client View

Automatically calculates FX trading profits/losses for each trade, each customer. From there, banks can get a 360-degree view of their customer's profile, pricing, risk, and transaction history.

Automatic

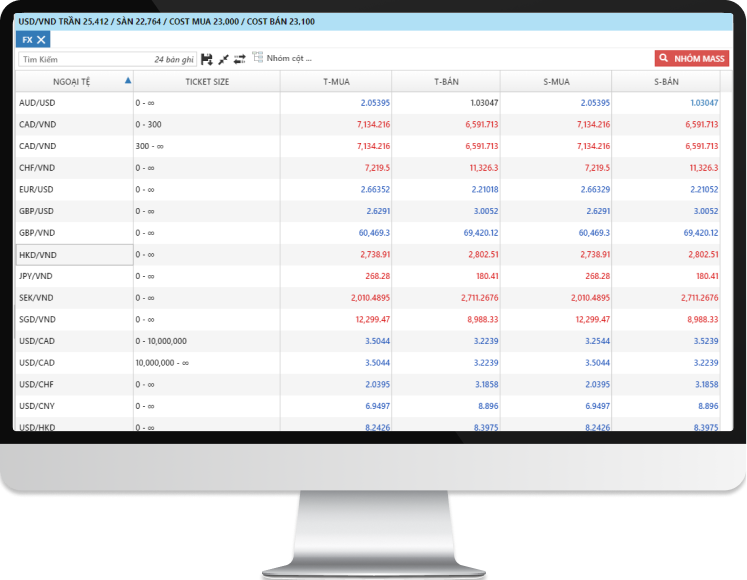

Exchange Rate Board

Automatically issue the Bank's FX rate board and seamlessly synchronize exchange rates to other systems: Core banking, Website,...

Constructing

Exchange Rate Matrix

Develop an exchange rate matrix for all customers by industries, sizes, market segments, and transaction habits.

Real-time

Competitive Pricing

Maintain an edge with competitive prices that are instantaneously and automatically updated across all branches and customers, and that are the closest to foreign exchange rates.

Comprehensive

Integration

Seamlessly integrates with core banking, treasury systems, centralized accounting (OGL), enterprise data warehouse (EDW), and furthermore, help streamline your internal processes.

Instant

Accounting & Payments

Simplify your financial workflow by experiencing automated and instant accounting and payment settlement processes.

Centralized

FX Management

FX status is automatically and continuously updated and centrally managed at bank's headquarters, providing the in-depth information necessary for strategic decision-making.

Multi-dimensional

Reporting

Monitor business performance across each customer, branch, segment, and division level. Simultaneously, easily keep track of the productivity and efficiency of RMs, Sales teams, and Traders.

Reduce

Operational Risks

Bank staff and branch controllers can proactively monitor transaction progress in a timely manner right on the NightVision FX system and ensure that errors are minimized with the warning system.

Maintenance and Support 24/7

By working with Novus, you will get prompt support at any time of the day. Our helpdesk is open 24/7, ensuring we are always available for your needs.

All Front, Middle, and Back-office Trading Functions integrate into one comprehensive FX trading platform

NightVision digitalized the Bank’s FX dealing processes by leveraging HTML5 technology

WE DELIVER OUTSTANDING PRODUCTS!

READY TO ELEVATE YOUR TECHNOLOGY WITH US?

NEWS from us

Last News & Events

NightVision FX Wins Sao Khue Award for Digital Banking Innovation

NightVision FX was honored with the Sao Khue award for its outstanding contribution to digital banking....

Read MoreGo Markets & Novus Fintech Launch Shares by GO Markets Platform

Congratulations to GO Markets in collaboration with Novus Fintech, successful launch of Shares by GO Markets...

Read More